What Buying Now & Paying Later Does To Your Brain, According To Research

More people are putting themselves into debt, using the buy now, pay later method.

Irene Miller | Shutterstock

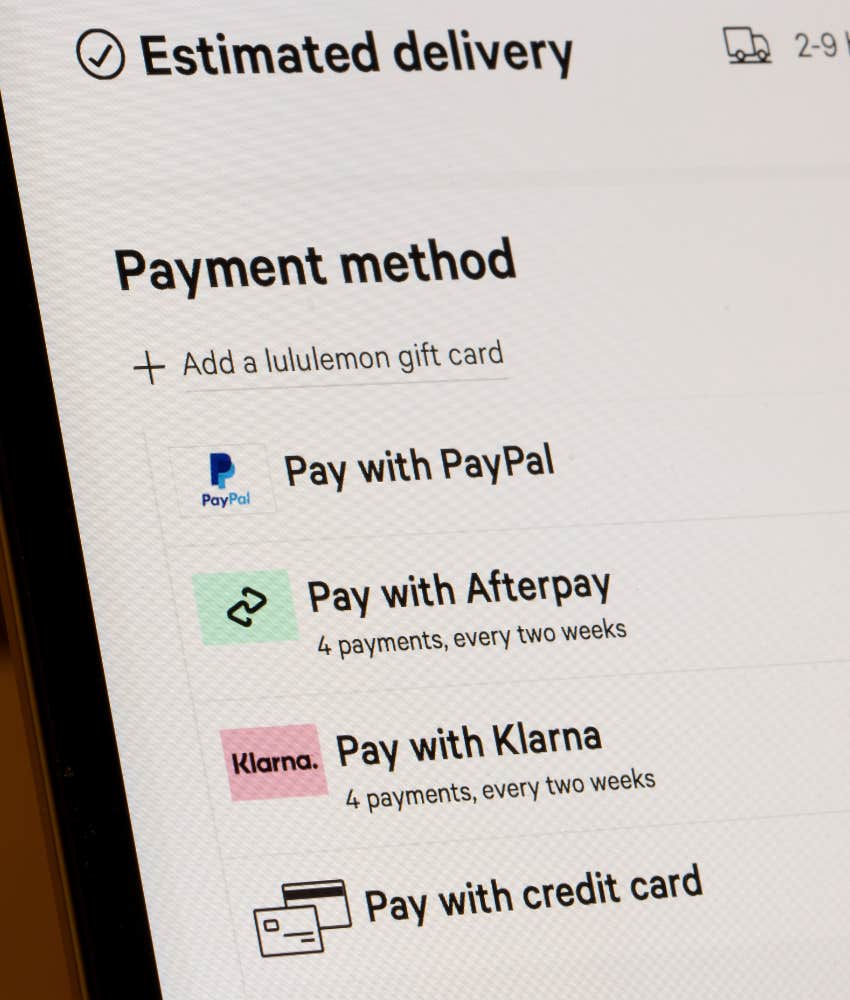

Irene Miller | Shutterstock Everyone enjoys indulging in online shopping every now and again, but for most retailers, every now and again simply isn't enough. That's where buy now and pay later companies like Klarna, Afterpay, and Affirm come in. Consumers get the option of buying without having to spend their money at the time of purchase. But is that actually a good thing? In theory, these services allow us to break up the cost of an item over a series of weeks, but research says this might not be all that great for our bank accounts or our mental health.

According to London-based mental health practitioner Ankita Guchait and accompanying research, using the buy now and pay later method is simply adding to the already high financial stress that many people are feeling. Guchait wrote for Psychology Today that we should be leaning on the side of caution when it comes to these purchases, and truly question if what you're buying is truly worth it.

Buy now and pay later services have an impact on your mental health

"The popularity of Buy Now, Pay Later (BNPL) plans has skyrocketed. They promise freedom and flexibility, but the ease of use can deceive our minds. When payment is deferred or divided into smaller payments, we are wired to feel less emotionally drained," Guchait explained.

Tada Images | Shutterstock

Tada Images | Shutterstock

According to a study, when the act of paying is separated from the act of purchasing, we end up experiencing less "pain of paying," which eventually makes us want to overspend because of the illusion that we're not actually spending a lot of money up front. Because of this psychological disconnect, people end up underestimating the long-term costs of what they're buying and indulge in more impulsive purchasing.

Of course, this just ends up putting people in more debt, which, in turn, leads to feelings of stress, depression, anxiety, and even suicidal ideation. Having debt has been linked to worsening health conditions and even higher levels of depressive symptoms. The psychological toll can be quite severe when financial strain ends up bleeding into your everyday life and starts affecting things like housing, food, and even education.

While shopping may bring quick relief, the long-term repercussions are worse.

"When we shop to alleviate sadness, boredom, stress, or low self-worth, we are engaging in emotional spending. Despite the fact that it may provide brief relief, it frequently results in deeper shame, particularly when the financial repercussions become apparent," Guchait continued.

It's always tempting to buy into the whole "buy now & pay later" method. Off the bat, it seems as if you're not having to spend as much money upfront because it's spread out over the course of three to four weeks. However, the initial sense of affordability can be quite a slippery slope into experiencing financial strain.

Sure, the promise of interest-free payments sounds good, but as Charles Schwab noted, you get zero protections or perks like you'd get from credit card use, and there are no benefits to your credit score. Actually, if you are unable to make your monthly payments, late fees and interest do impact your credit score for the worse. As the financial outlet stressed, if you are contemplating a big purchase and you don't have the funds to pay for it outright, your best bet is to budget and save because if you default on buy now, pay later, it's worse than not having the item in the first place.

Most people using the 'buy now, pay later' aren't actually paying later.

Klarna, the most popular buy now, pay later company, recently revealed that many of its customers are struggling to pay their loans. They reported that their net losses doubled in the first quarter, even though their user base and revenue grew.

They admitted that their credit losses shot up to $136 million, 17% higher than in Q1 2024. It's similar to a survey conducted by LendingTree, which found that 41% of its users said they paid late when it came to their loan payments. At least a quarter of buy now, pay later users even took out loans to pay for groceries, which isn't surprising considering how many people are living in financial insecurity.

Nataliya Vaitkevich | Pexels

Nataliya Vaitkevich | Pexels

It seems the one thing that most people are really struggling with is financial education. We rarely seem to talk about money in our communities, friend groups, or with family. Money has remained a taboo topic, but by keeping it as such, we're doing ourselves a disservice by not being able to come together to learn. If we actually spoke about the struggles, that feeling of needing to keep up with the Joneses might disappear or at least diminish greatly.

By actually addressing the financial strain that so many people feel, we can slowly start to heal and even make better decisions. It's the shame and loneliness that are making things worse. The emotional toll that money takes on people is very real, and until we start addressing it and actually sit down to have these conversations, we'll never learn and move forward.

Nia Tipton is a staff writer with a bachelor's degree in creative writing and journalism who covers news and lifestyle topics that focus on psychology, relationships, and the human experience.