11 Things That Were Affordable A Year Ago That Normal People Can't Afford Anymore

As prices rise, people have to choose between wants and needs based on what they can afford.

voronaman / Shutterrstock

voronaman / Shutterrstock Several factors within the economy and environment play into how much the average person is able to afford now versus what they could afford just a year ago. An increase in inflation, tariffs, supply chain issues, and weather issues all make it more financially difficult for normal people to not just afford the things they want, but also the things they need.

With the cost of most things increasing, you’d expect that wages would also increase at the same pace to help people actually be able to afford at least necessities, but sadly, that is not the case. Wages, while increasing to some degree, have not nearly seen the same amount of growth as prices have, and this slow growth rate impacts the average person’s purchasing power. What most people could afford a year ago, they’d now struggle to be able to purchase.

These are 11 things that were affordable a year ago that normal people can’t afford anymore

1. Groceries

Studio113 / Shutterstock

Studio113 / Shutterstock

With grocery prices increasing, but wages barely seeing the same increase, the average person struggles to afford most grocery items. Within the past year, grocery prices have increased more than 2.0% and are predicted to continue rising throughout the rest of 2025 and into 2026.

No longer is it an option to adopt a healthy diet and clean, unprocessed foods without suffering financial strain. Most people instead have to settle for less expensive processed food items that might not fit into their preferred diet, but instead fit into their current budget.

2. Gasoline

CHARAN RATTANASUPPHASIRI / Shutterstock

CHARAN RATTANASUPPHASIRI / Shutterstock

Although gasoline prices have recently seen a decrease in some areas, gas is still an extra expense that leaves most people dreading the next time they have to visit the gas station. The average price per gallon of gas, as of August 2025, was $3.14.

For individuals who have to drive longer distances for work every day, having to possibly make multiple trips to the gas station each week starts to add up. Even when certain things see decreases in prices, the more recurring the purchase has to be, the less and less the decrease seems to make a difference in terms of affordability.

3. Rent and housing

Bilanol / Shutterstock

Bilanol / Shutterstock

While rent and housing prices vary depending on geographical location, for most places, the current cost of housing is substantially higher than it was in previous years, making it much more difficult for the average person to afford. Potential homebuyers face the inflated prices of a home, as well as rising interest rates, and many renters find themselves owing more than a third of their monthly income towards rent.

Although renting brings its own financial stressors, most people still choose to rent over buying a home in hopes of saving at least some money. Many individuals are unsure if they will ever be homebuyers, considering the consistent unaffordability that consumes the housing market.

4. Dining out

rblfmr / Shutterstock

rblfmr / Shutterstock

An increase in inflation has caused restaurants to increase their prices, resulting in many people choosing to lower the frequency of their dining out or eliminate this extra cost altogether. If individuals do choose to eat out, it is usually at fast food restaurants that offer value meals and other deals.

Others may choose to prepare meals at home, but as grocery prices have also increased, the options even at home become more limited. Eating healthier at home gets difficult, and eating healthy meals while dining out starts to feel impossible.

5. Utilities

brizmaker / Shutterstock

brizmaker / Shutterstock

While inflation and supply chain issues are significantly impacting the cost of utilities, environmental factors play a role as well. As we experience more extreme weather conditions, energy usage increases, causing individuals to have to pay more each month on utilities than in previous years.

This also sparks worry in many people who are concerned that essential utility prices will only continue to increase. This worry especially surfaces when individuals consider the environmental transition to cleaner energy sources, which will inevitably bring about factors that increase costs.

6. New cars

K-FK / Shutterstock

K-FK / Shutterstock

The price of new cars has seen a huge increase, making them harder to afford. When there were once more affordable car models to choose from, people could purchase a new car for no more than $25,000, but now the more budget-friendly options are scarce.

Most people now choose to settle for used cars, which have seen a slight drop in prices, in an attempt to find something more affordable.

7. Public transportation

Scharfsinn / Shutterstock

Scharfsinn / Shutterstock

For individuals who find used cars too expensive, public transportation is a necessity for getting them where they need to be. While public transit is still the cheaper option, due to the savings it offers, when it becomes a daily expense, the cost only gets higher and higher.

Although prices for public transportation continue to increase, there may be a chance that it will become more affordable again soon. Areas where public transit is prevalent are currently determining what possible solutions can help lower costs, such as reduced-fare programs and system-wide free transit.

8. Electronics

Wongsakorn 2468 / Shutterstock

Wongsakorn 2468 / Shutterstock

For most, a phone and laptop are essentials for everyday communication and accessing work. The current price increase that has been the result of inflation and recent tariffs has made it difficult for the average consumer to obtain these essentials.

Most electronic manufacturers build products with a short lifespan, so even individuals who have current access to these devices face potential financial strain when it comes time to replace the device. This price increase is also expected to continue within the next few years, so it is hard to say exactly when electronics will become more affordable again.

9. Healthcare and insurance

PeopleImages / Shutterstock

PeopleImages / Shutterstock

Although healthcare and insurance are necessities, most individuals struggle to keep up with the rising costs and afford them. Higher deductibles, premiums, and out-of-pocket expenses have all contributed to making healthcare and insurance unaffordable.

Since most wages are not increasing at the same pace as healthcare and insurance prices are, people are left with either financial burden and the potential of out-of-pocket costs, or delayed medical care and worsening health problems.

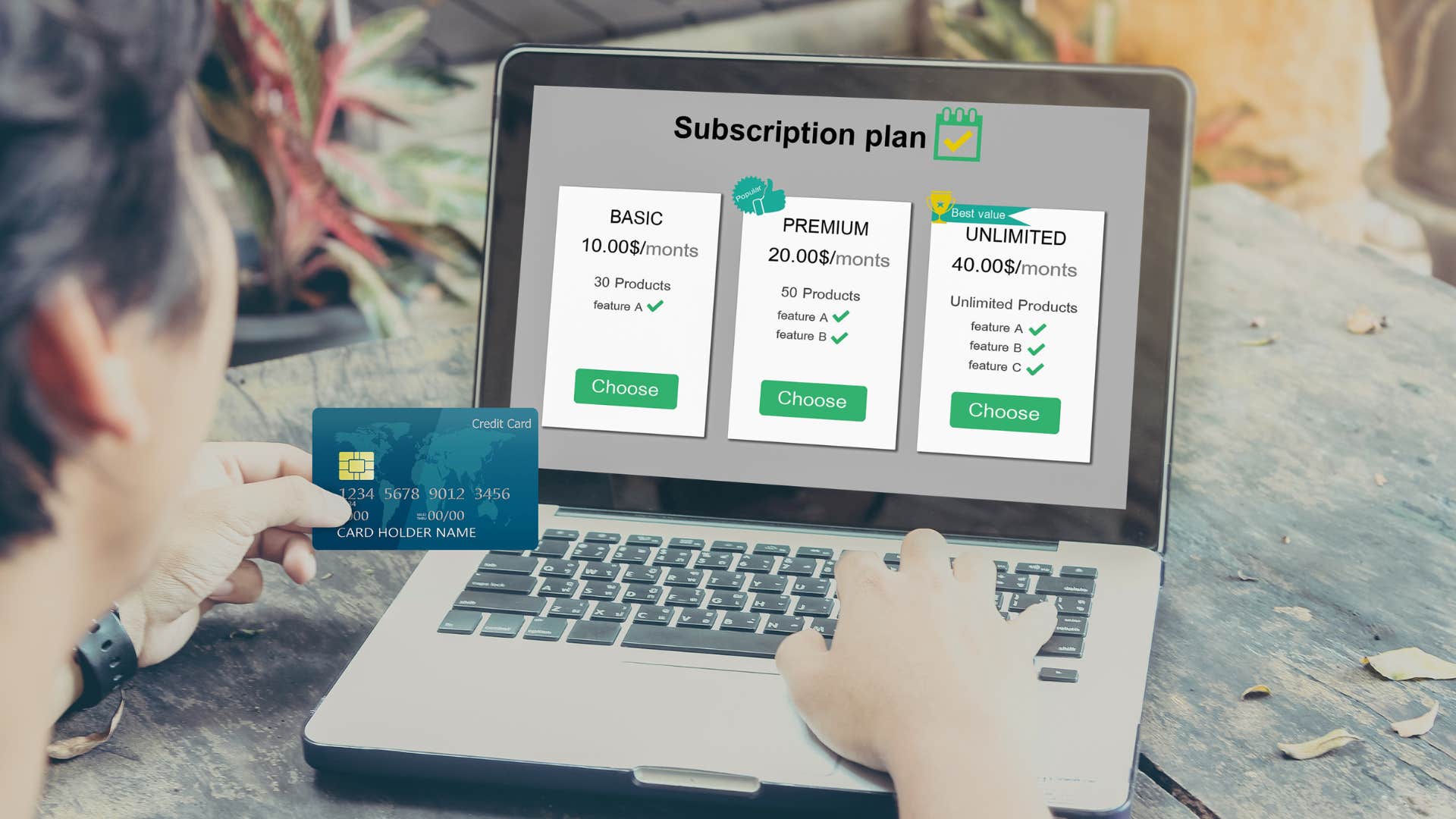

10. Subscriptions

panuwat phimpha / Shutterstock

panuwat phimpha / Shutterstock

Streaming subscription prices have also increased rapidly, making it difficult for people to continue affording them. Most subscriptions being viewed as wants rather than needs make them one of the first things to go when financial strain hits.

Most Americans end up paying close to $100 every month on subscriptions. In addition to the increased costs of most necessities, it makes sense that people consider the extra $100 on subscriptions the first thing to get cut from their budget.

11. Airline tickets

Song_about_summer / Shutterstock

Song_about_summer / Shutterstock

Several factors, such as higher demand, increased operating costs, and premium offerings, have all contributed to making airline tickets less affordable. While traveling may not always be a necessity for most individuals, it used to be a want for some that was much more attainable.

As of June 2025, airline ticket prices saw a 25% increase, making it difficult for regular travelers to afford travel. It also, similar to subscriptions, becomes an extra cost that many people will choose to cut out if their income has to go towards other things that seem more necessary.

Most people would love to be able to afford not just what they need, but also what they want. While many things will continue to increase throughout the year, there is hope that eventually these things will once again become affordable for the average person.

Kamryn Idol is a writer with a bachelor's degree in media and journalism who covers lifestyle, relationship, family, and wellness topics.