A Woman Explains Why Just One Year Of Her Daughter's College Will Cost $100,000 More Than She Was Quoted

Unfortunately, this is the dismal reality for many college-bound students who are faced with high tuition fees.

@stacyann370 / TikTok

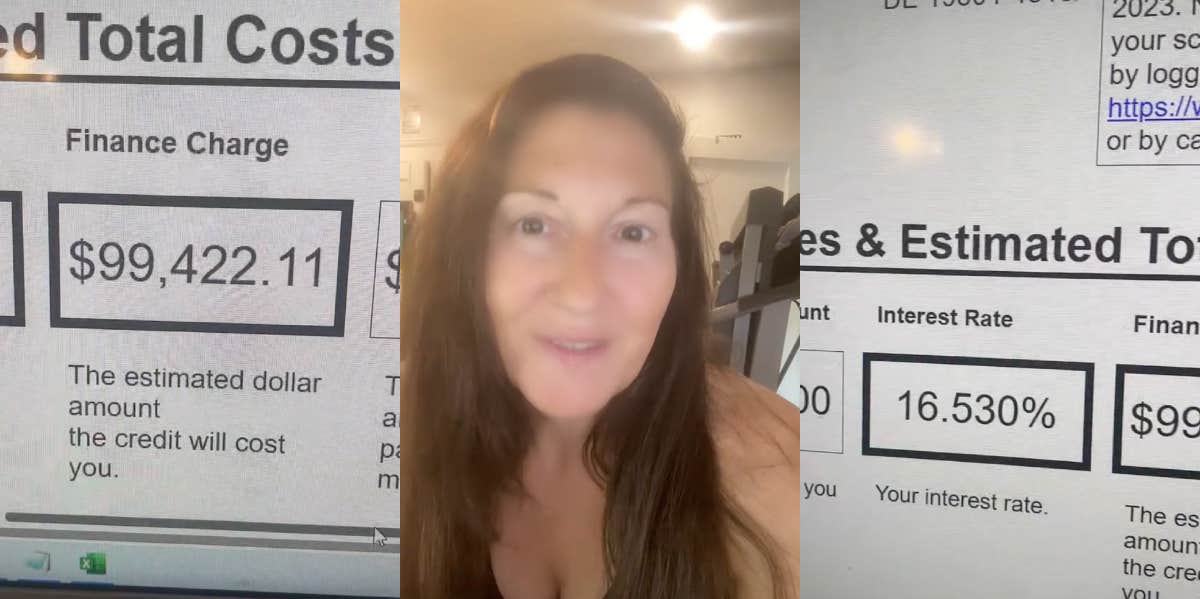

@stacyann370 / TikTok A mom shared the bleak reality of how expensive it is for people to go to college and get a degree.

In a TikTok video, a mom named Stacy revealed that she had been applying to be a consigner for her daughter to take out a Sallie Mae loan for her second year of college. However, upon noticing the high total for the loan amount, Stacy was taken aback at how much her daughter would've had to pay back once she graduated.

She explained that a loan amount for just one year of her daughter's college would be over $100,000, even though the cost to attend was less than $30,000.

"So my daughter is going into her second year of college. The first year I took the loan out for her, it was a private loan [and] the rates weren't bad. This year to be a cosigner for Sallie Mae to borrow $28,355 at 16%, the finance charge is $99,422.11," Stacy began in her video.

She continued, saying that when she was done paying back the $28,000, she would also have to pay Sallie Mae a total of $127,777. "This is sickening," Stacy pointed out. "This is predatory, this shouldn't even be legal."

Thankfully, Stacy was able to read through the terms of the loan agreement and catch the astronomical price before agreeing to take out the loan, but acknowledged that many teenagers going off to college might not have that same choice.

"I'm never going to allow my daughter or myself to have to pay Sallie Mae $127,000. We would have to pay $100,000 just to borrow $28,000. That is absolutely ridiculous. I feel so bad for other college kids that have to deal with this."

Stacy remarked that if she had agreed to the Sallie Mae loan, her daughter would have to pay a total of $380,000 for the next three years of her college experience, and if she had taken out loans for her daughter's first year of college, it would've been $400,000 just to get a degree.

"I'm not allowing my daughter to take this," Stacy stressed. "She will end up having to work and give you all of her money for probably her entire life. Things have to change."

There are fewer teenagers attending college because of how high the cost of tuition is.

In a survey of high school students, it was found that the likelihood of attending a four-year school sank nearly 20% in the last eight months — down to 53%, from 71%, according to ECMC Group, a nonprofit aimed at helping student borrowers.

Most of that is due to the rise in college tuition and, according to College Board, tuition and fees plus room and board for a four-year private college averaged $50,770 in the 2020-21 school year; at four-year, in-state public colleges, it was $22,180.

For college-bound students and their parents, 98% of families said financial aid would be necessary to pay for college and 82% said it was “extremely” or “very” necessary, per the Princeton Review’s 2021 College Hopes & Worries survey.

A majority of high school students also said they are now applying to colleges with lower tuition prices, while another third said they were applying to colleges closer to home.

The skyrocketing tuition fees and predatory lending practices have created a distressing situation where many 18-year-olds are forced to make life-altering decisions about their future while dealing with these monumental loans and tuition prices. The weight of these financial burdens not only affects bank accounts but also dreams, aspirations, and mental well-being.

Nia Tipton is a Chicago-based entertainment, news, and lifestyle writer whose work delves into modern-day issues and experiences.