Irritated Customer Shows 3% ‘Employee Benefits & Retention’ Fee Added To Their Bill At An Airport Convenience Store

MAYA LAB | Shutterstock

MAYA LAB | Shutterstock It’s safe to say that most people are pretty much done with tipping culture at this point. But, the thing about tipping is that you get to decide whether or not to do it, and how much money to leave if you do. You don’t have the same option if an additional fee is automatically added to your bill, though.

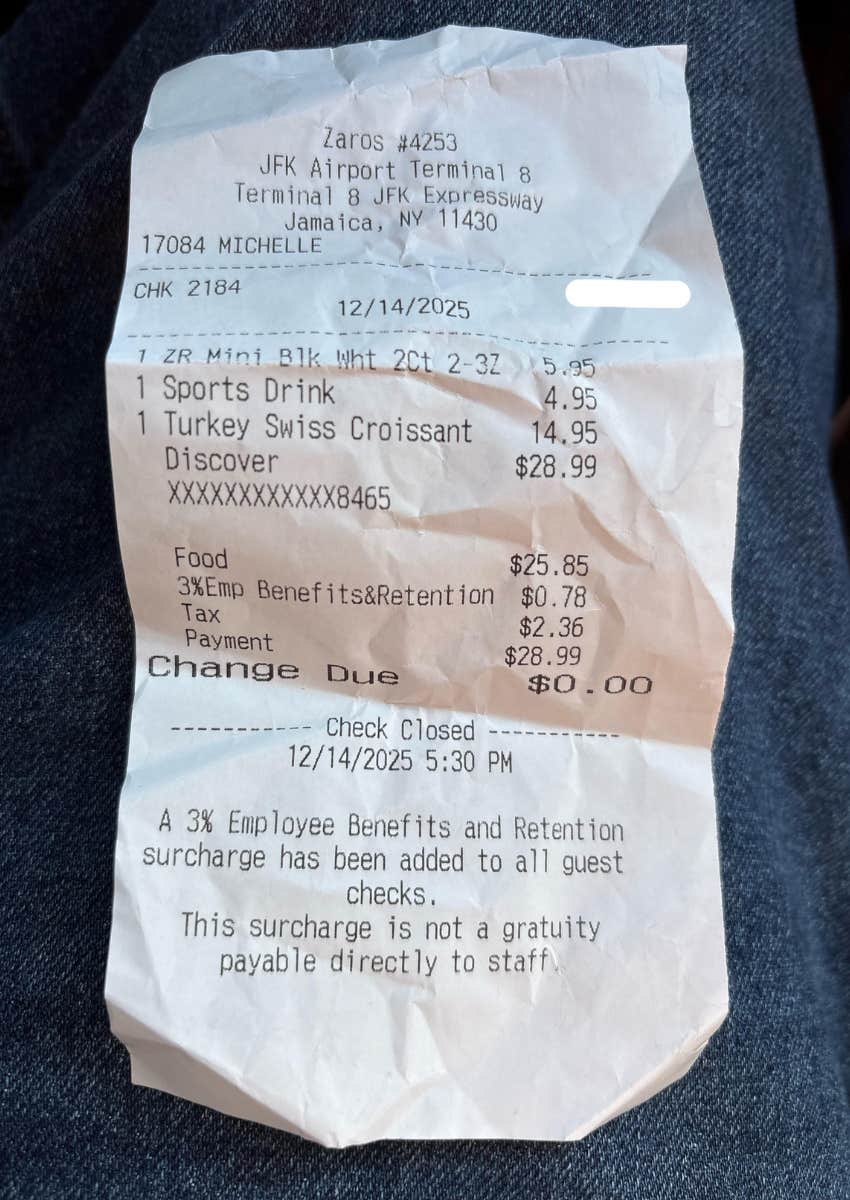

That’s exactly what happened to one customer who was just trying to pick up a few items at an airport convenience store. When they got their receipt, they noticed a strange charge that was added to the bill without their knowledge. Now, people are debating the legality of adding such a fee to a bill without the customer’s knowledge, and agreeing that it just doesn’t look good from an ethical standpoint.

The irritated customer shared their receipt as proof of the sketchy charge added to their bill.

In the r/EndTipping subreddit, a user posted an image of the receipt from Zaros, a convenience store at JFK Airport. It wasn’t a huge purchase — just a small meal that totaled $25.85. The tax on the purchase was $2.36, but the overall charge was $28.99. That left $0.78 unaccounted for in the total, but Zaros had an explanation for that.

Reddit

Reddit

“A 3% Employee Benefits and Retention surcharge has been added to all guest checks,” the receipt read at the bottom. “This surcharge is not a gratuity payable directly to staff.”

The Redditor was baffled. “Whatever that means,” they said by way of a caption.

Most people thought this charge was completely wrong, and even wondered if it could be considered fraud.

“This is a ‘junk fee.’ Absolutely nothing to do with tipping,” one person pointed out. Others joked about the relatively low cost of the fake “tip,” with one saying, “3% tip ain’t that bad for once!”

Somebody else shared that the same thing happened to them. “I had this exact same thing show up while I was paying for a couple of beers at the San Francisco airport [the] day before yesterday, and it isn’t mentioned before you go to pay,” they said.

“That needs to be disclosed prior to ordering,” another Redditor said. “There needs to be legislation to curb these tactics. It’s consumer fraud,” another user added. One person seemed to get to the heart of the issue when they said, “They don’t care about retention. Come on!”

An expert says businesses may have a good reason for adding this fee to bills.

As a customer, it seems incredibly annoying to have a charge like this added to your bill, which already isn’t cheap. But Matt Notowidigdo, a professor of economics and business at the University of Chicago, told NBC 5 Chicago there’s a reason we’ve seen this pop at businesses in recent years.

Andrea Piacquadio | Pexels

Andrea Piacquadio | Pexels

“It’s worth asking, why are we seeing this in restaurants now?” he said. “The simple answer is when the pandemic economy recovered after the reopening, some of the sectors that were hit hardest were anything connected to leisure and hospitality and healthcare.”

He continued on to say that these businesses have to pay their employees more and give them better benefits to keep them on staff. So, it sounds like this money actually is going towards retaining employees. Also, it seems like this does not meet the standard of “Consumer Product and Retail Fraud” as outlined by the Office of the Comptroller of the Currency.

It’s frustrating to have to pay an extra fee like this when you’re already giving a business your hard-earned money. And, quite honestly, it seems like it should be the business’s responsibility to use the money they’re already bringing in to better compensate their employees. But this seems like an unavoidable aspect of the consumer experience, at least for now.

Mary-Faith Martinez is a writer with a bachelor’s degree in English and Journalism who covers news, psychology, lifestyle, and human interest topics.